When Excel first hit the market, current Microsoft CEO Satya Nadella had only just begun the second year of his electrical engineering course at India’s Manipal Institute of Technology.

Over the next three decades, spreadsheet software came to dominate the world of budgeting and planning.

But while it’s undoubtedly still the king of FP&A tools, Excel’s crown is being challenged. As we discuss in The CFO’s Guide to Agile Financial Modeling, the role of finance chief has changed beyond all recognition since Excel first appeared on the scene. Excel isn’t keeping up.

And yet it’s still overwhelmingly popular. With more than 750 million users worldwide today, no competitor comes close. According to Robert Half’s “2018: Benchmarking the Accounting & Finance Function” report, 63% of US executives said their companies rely on Excel as their primary tool for budgeting and planning.

What’s behind the software’s enduring appeal? What does it do that other tools can’t? And if it’s still so popular, why should you look for an alternative? Find out as we explore the pros and cons of Excel for corporate finance.

Why has Excel been the FP&A team’s favorite tool for so long?

The tech world is a fickle place. It’s remarkable that Excel has lasted the course when so many others – Lotus 1-2-3, SuperCalc, and Borland Quattro, to name just a few – have failed.

But it’s no coincidence that Excel is still number one. Even today, there’s a lot to love about it. Here are the biggest reasons that FP&A teams have been so reluctant to part with Excel:

Creative empowerment

Excel allows your team to model creatively, free from the restrictions of a dedicated CPM platform. And it lets you work independently, without having to rely on third-party support when something goes wrong.

Ease of use

Mostly intuitive and relatively easy to learn, Excel rewards users who are prepared to put in the time to master its wealth of functionality. Even today, advanced spreadsheet ability is one of the most desirable skills for a finance professional to possess.

Effortless integration

Microsoft Office has a vast user base. A 2017 Spiceworks study found that 83% of organizations across the globe use Office 2010 somewhere on their networks, while older and newer versions of the software suite are in varying degrees of use:

Excel’s ability to integrate seamlessly with all those other Microsoft tools – from Outlook and Word to PowerPoint and OneNote – is yet another reason for its longevity.

Tailor-made templates

A Google search for “financial modeling excel templates” brings up 4.8 million results. If you don’t have the resources to build a new model from scratch, someone somewhere will already have created one for you.

Cost

An easily overlooked point, but there’s a reason why so many businesses – particularly smaller ones – love Excel. A Microsoft Office subscription might set you back as little as $8.25 per user per month; a big vendor CPM solution could cost thousands of times more.

Why is Excel insufficient for today’s finance teams?

The death of Excel has been anticipated for years – and yet it’s still in widespread use. So why is now the time to seek out an alternative?

Some sources would have you believe that spreadsheets simply don’t work. That they’re a relic of a bygone age. No longer trendy enough for the contemporary workplace. Indeed, a survey by Adaptive Insights discovered that CFOs no longer value Excel proficiency as the most important skill for finance professionals. Only 7% listed Excel skills as important for new hires, while just 5% named proficiency in Excel as the top skill for their FP&A team.

But, like us, Adaptive Insights sells a CPM solution. To say it has a vested interest in making Excel look bad is perhaps the understatement of the century. What Adaptive won’t tell you is that to perform a range of basic financial planning tasks, its users still need to revert to Excel.

Spreadsheets aren’t the problem. They’re still an invaluable FP&A tool. The issue lies in the limitations of Excel, which is severely lacking in each of these key areas:

Scalability

Excel simply fails to scale. Once your business hits a certain size, your finance team will quickly find themselves drowning in spreadsheets.

Collaboration

This leads to another problem with Excel; it’s notoriously poor at supporting collaboration, forcing your team to operate in silos and presenting an insurmountable barrier to agile working.

A single version of the truth

With each member of your team working on their own, you’re left with dozens – if not hundreds – of similar spreadsheets floating around on individual desktops. Each one will likely have been tailored to the user’s preferences. How do you know which represents the truth?

Is there still a place for Excel?

Despite its many shortcomings, Excel still has a part to play in the modern FP&A world.

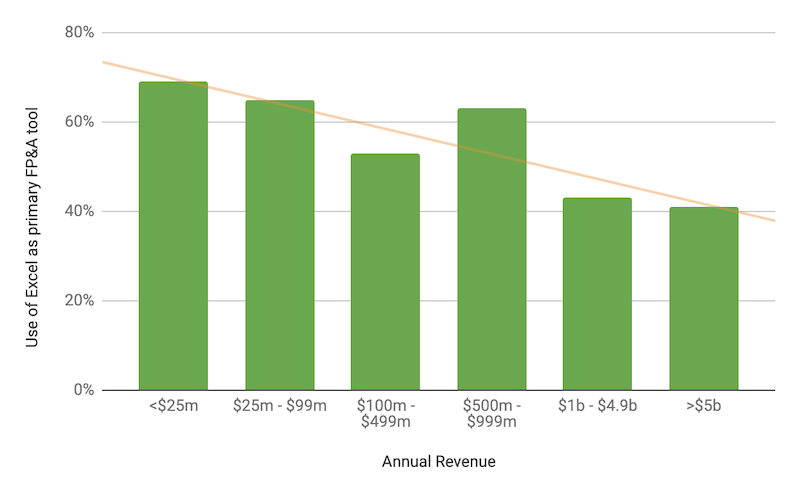

It’s telling that smaller businesses are more likely to still be using Excel. Robert Half’s research shows that 69% of American companies with annual revenues under $25 million use it as their primary budgeting and planning tool, dropping to 43% for companies making $1 billion to $4.9 billion per year, and 41% for those with revenues exceeding $5bn.

This speaks to Excel’s greatest area of strength – as demonstrated by our Financial Modeling Agility Quadrant. It empowers small FP&A teams to build budgets, create forecasts, and run what-if analyses quickly, creatively, and self-sufficiently.

How to leverage the pros of Excel without the cons

The strengths of Excel are undeniably attractive. However, its weaknesses make it unpalatable for large and/or high-growth enterprises that require agility and scalability. If only you could enjoy the pros of Excel without the cons.

Actually, you can. Using the power of the cloud, Excel can be transformed into a tool that retains all the spreadsheet functionality your FP&A team craves, while doing away with its crippling lack of scalability.

Excel-friendly models can be built at scale in the cloud, doing away with Excel’s fragility and capacity limits. Time-consuming spreadsheet maintenance is eliminated, freeing up your team to add real value through creative forecasts and what-if analysis. And there’s no need to rely on IT and outside consultants to overcome software challenges.

We call it Agile Financial Modeling.

Ready to see what Agile Financial Modeling looks like? We’re happy to show you. Request your free custom demo today.