Break free of the groupthink that would have you believe corporate finance teams desperately need a CPM to rescue them from Excel.

There is a certain groupthink prevalent in our industry when it comes to CPM vs. Excel. It reinforces the view that Microsoft spreadsheets are a relic of the past and are to be avoided in business planning. It’s an assumption that bears costly and inefficient fruit for many corporate finance teams.

Admittedly, the painful shortcomings of Excel are problematic. A recent survey report published in the Harvard Business Review has some key takeaways:

- 90 percent of respondents still use spreadsheets as a primary corporate planning tool

- Less than 25 percent said they are satisfied with those spreadsheets

The conclusion the authors draw from these stats, however, is flawed.

The False Dilemma: CPM vs. Excel

“Siloed spreadsheet-based planning, complete with system crashes and version-control issues, can no longer support today’s scale or pace of business,” the report concludes. “Instead, flexible and agile planning can happen only when companies have a more connected view of data that springs from a common source and then flows across the organization.”

On this, I think we can all agree. The report, however, offers up one and only one solution, painting the picture of an either/or choice between traditional Excel and corporate performance management (CPM) platforms such as those being sold by highly funded darlings like Anaplan and Workday, as well as behemoths like IBM and Oracle.

The industry narrative would have corporate finance teams believe their affinity for Excel is foolish, backwards, and misplaced. That those who fail to wean themselves from Excel quickly face a bleak future indeed, according to the report: “They will likely be left behind, and fast.”

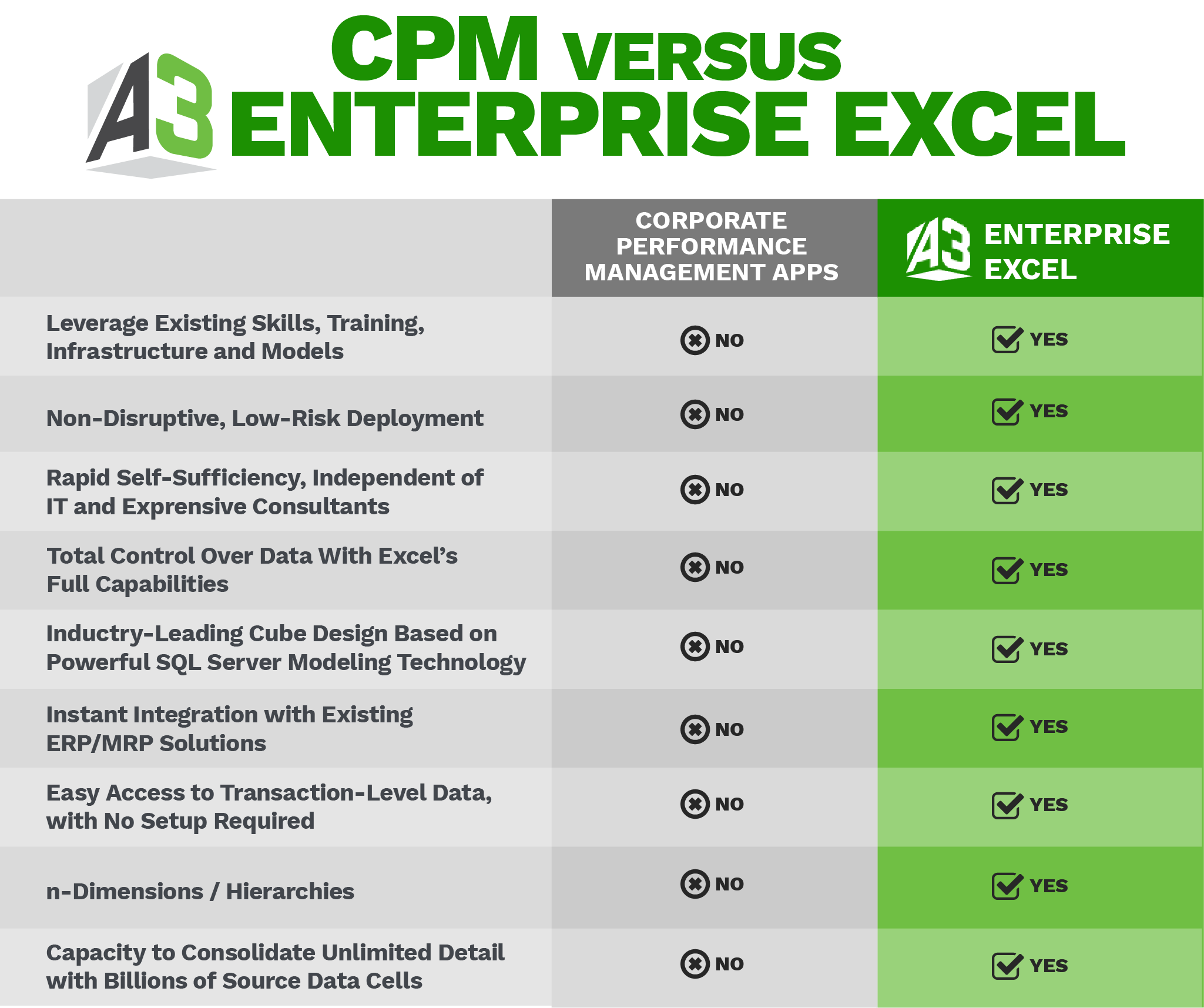

But it’s not about CPM vs. Excel. What if you could keep Excel and continue to enjoy the control, self-sufficiency, and creative license you’ve come to rely on while achieving all of the benefits of CPM software, including single version of the truth, secure multi-user workflow, intuitive analysis, and reporting? What if you could keep Excel and, in the words of the HBR report, “react quickly, increase productivity, and compete effectively?”

You can … with Enterprise Excel.

Enterprise Excel isn’t just comparable to CPM apps. It’s better. It has transformed the spreadsheet program that has long been the backbone of corporate finance into a powerhouse that is fast, stable, and secure enough for even the biggest enterprise. Say goodbye to the choice of CPM vs. Excel, and hello to Enterprise Excel.

What Is Enterprise Excel?

Rather than throw your spreadsheets away and reinvent the wheel with a CPM, you can try an Enterprise Excel app and transform Excel into an enterprise platform.

Enterprise Excel gives you all the benefits of Excel plus the following:

A3 Modeling, for example, allows teams to continue to work within the familiar Excel environment while scaling your models to cloud cubes with 1,000 times the capacity, a direct link to your general ledger and other source systems, and multi-user security. In such an arrangement, the capacity, version control, and fragility issues of traditional end-user Excel are eliminated, and the models are unbreakable, remaining penny-accurate with automated data flows.

There are no switching costs to rip out your old Excel spreadsheets and replace them with an entirely new system. There’s less business interruption because you’re not losing time and productivity while your financial analysts are trained in new technology. User adoption goes smoothly because the user is already at home in the Excel environment. Plus, the cubes that turn Excel into enterprise Excel are designed and managed by the finance team—not IT or high-priced consultants.

Only Enterprise Excel allows financial analysts to build on the years of experience they have with the industry standard spreadsheet program instead of having to start from scratch with a completely new CPM system.

Financial analysts are some of the most underutilized assets at most corporations. Enterprise Excel empowers them by keeping them in control of their new system, encouraging self-sufficiency and leveraging their hard-earned Excel modeling skill and creativity. Instead of maintaining spreadsheets, analysts can use their talents to perform driver-based revenue forecasting, expense budgeting, compensation planning, capital budgeting, allocations, supply-demand forecasting and profitability forecasting.

So the next time you read about the imminent extinction of spreadsheets, dismiss the CPM vs. Excel groupthink and ask: “What if I could have both?”

A3 Solutions

A3 Solutions